The following article was transcribed from a conversation with Omer Sidi, the chief broker of the Trust The Brokers agency. He manages the Amazon department at the agency and is responsible for all our Amazon transactions.

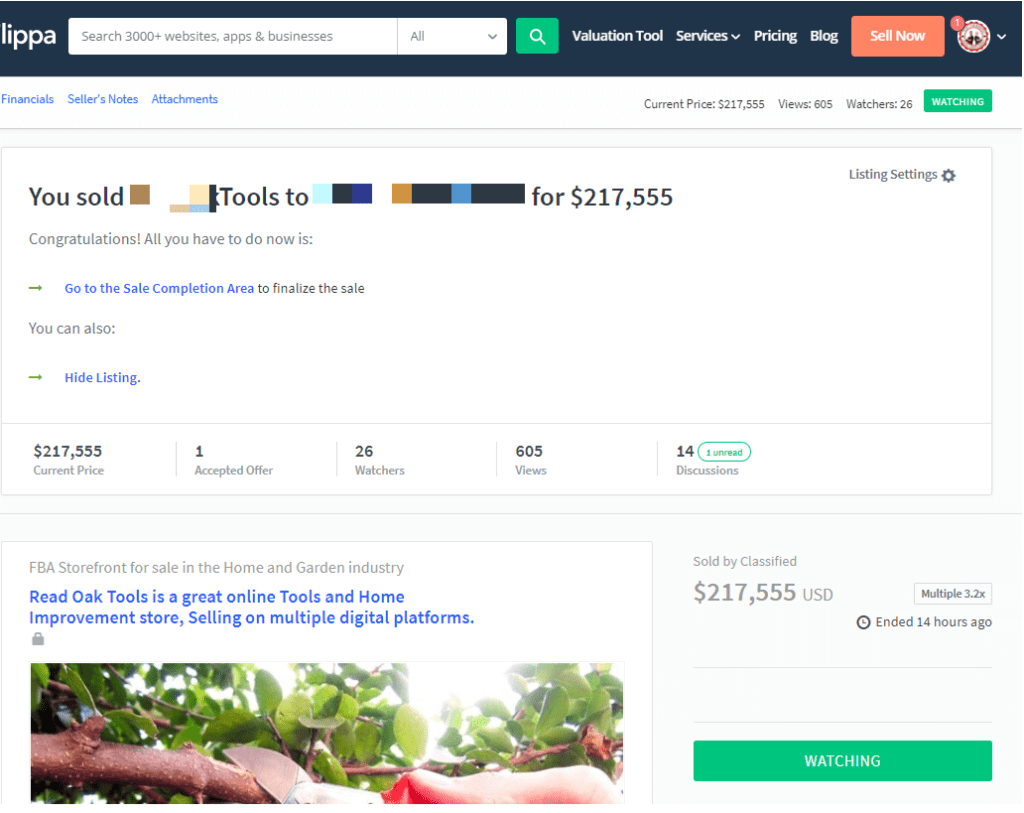

Omer has primarily focused on Amazon for the past six years. He owns several stores and is an external consultant to private sellers and companies. In the past, Omer studied law and has the bonus of speaking English as a mother tongue. As a result, he has the professional and legal knowledge to help our clients and accompany them in making successful deals. This conversation with Omer took place after a very successful Amazon deal and money transfer (see image below).

If you are looking to buy or sell Amazon stores, you’re in the right place. Our agency handles all types of stores, from tens of thousands of dollars to millions of dollars. Below is the best complete guide to selling Amazon FBA stores that you can find online today. All the tips were compiled from extensive experience.

Before you continue feel free check our Amazon business now for sale in our marketplace

WHAT IS AN AMAZON FBA STORE?

FBA is an acronym for Fulfilled by Amazon, but what does it mean? The simple explanation is that the owner of the Amazon store owns the brand and the products. They are required to prepare the products and ship them to Amazon’s warehouses. Once the products arrive at Amazon’s warehouses, Amazon oversees further logistics. They receive the goods, scan, store, and finally send them to the final customer. Our agency handles acquisitions of FBA stores both from the seller’s side and from the buyer’s side.

The key strengths of an Amazon business are:

-Initial set-up costs are low in comparison to most businesses. You can usually start with an investment of $5000-10,000.

– No need for warehouses or offices – all you need is access to a computer.

– It’s the most prominent platform available today that allows you to sell to customers worldwide.

-The option to sell your Amazon business usually occurs within a short period.

What are the costs involved in setting up and managing an Amazon FBA model store?

Let’s divide this subject into two parts:

One-time set-up costs refer to opening the store, writing a list, taking and editing photos, video, keyword research, distribution units, PPC costs within Amazon, and the budget for purchasing initial inventory. There may, of course, be additional expenses that vary from business to business. The total cost can reach $5000 -10,0000 depending on your budget and the professionals you hired. For example, you can take photos alone for free (we don’t recommend this route), or you can contact a professional photographer who will photograph and edit the pictures for you. There is often an option to cut expenses, but from our experience, it usually doesn’t benefit you in the long run. Therefore, we don’t recommend cutting any of these necessary initial steps but instead investing essential time and money. This initial investment can be the difference between a product that sells and succeeds and one that fails.

Let’s discuss current costs. Amazon’s service does, of course, cost money, but how much? The answer varies from product to product and from category to category. For example, for products in the range of $15 to about $30, most of the commissions we should consideration are about 30% of the product’s price to the customer.

So, for example, a product that cost us $10 with shipping and sold for $30 to the end customer- would have a commission of $10. Amazon’s commission includes sales, shipping, storage, packaging, and other expenses that we won’t expand on. Roughly, it would leave us with about $10 profit per unit. Make sure to consider different types of unforeseen expenses, such as returns, cancellations, and defective products- to evaluate correctly and prepare accordingly. We see many sellers who don’t do correct calculations and, in the end, are left without profit or with only meager profit margins. It is essential to know the numbers of your business. This rule is valid, by the way, for any business and not just for Amazon.

What do our potentail buyers looking for?

When looking for an Amazon store to purchase, we primarily search for potential. Of course, a potential investor wants to see a store that’s making a profit, and that, with the investor’s added skills and abilities, has the potential to earn more. But, of course, the question is also what product or products one sells in the store. Are they generic or unique? Is there product differentiation or not, is there a patent for the product? Naturally, the more unique and able to be protected our products are, the higher our chances of finding buyers. Therefore, when reviewing an Amazon store, one must take a whole set of considerations into account to examine the transaction’s viability.

Types of Amazon Stores for sale

The first type of business on Amazon are stores that sell generic products /off-the-shelf products. For example, products that you can order from Alibaba and that the supplier can add your logo to. This generic type product is the primary type of PL product in an Amazon store, and most often, these products have a short lifespan, a lot of competition, and prices that will go down over time.

Why is this? Because anyone can contact a supplier and make a deal to sell the same product at a lower price or in a different color.

The second type of store sells something unique, such as a product with very little competition, a patented product, or one with a unique design or component. A multiplier store that sells this type of patented or particular product can be much more than a store that sells basic generic products. There are, of course, always exceptions.

How to Value an Amazon FBA Business?

When we wish to price an Amazon store, the main factor is, first and foremost, the profits. First, look at the store’s profit and loss statement (P&L) from the last 12 months. Then, look at what the store has done in previous years, such as sales reports, advertising reports, competitors, additional business costs, store status, store seniority, its look, reviews, feedback, complaints, and more. Each potential buyer does their own check, and every investor has points that are more or less important to them when considering such an investment. In addition, there are companies that can perform these tests for potential buyers.

There are many different parameters for pricing an Amazon store. Here are a few of them: Is the store profitable? If so, then what is the percentage of profit? Is it possible to protect the product from copying? Is it possible to develop more products under the same brand? Is there a patent for the product? Are there product reviews? How many reviews? And are they positive? And what about negative reviews? Health condition of the store? Has it received complaints? Is the store at risk? Is the product seasonal? Are there competitors? If so, how many and who are they? What is the lifespan of the product?

And you can keep asking more and more…

How much can you make in amazon deal?

This is an excellent question, for the range is enormous. Some stores will sell at a multiplier of 1.5 (annual profit), while in other extreme cases, they will sell at a multiplier of 5 (annual profit). In rare circumstances, it can sometimes be for even more. Most businesses lay somewhere in the middle, between a multiplier of 2.2 to a multiplier of 3.5. In the first stage of the process, our agency dives into all the business’s info. We check all the data, perform an analysis and provide a valuation of the store- all for free! If we look at a concrete example: a store that earns about $100,000 annually, it should be possible to get a price of between $200,000 and $350,000.

* The example and calculation refer to an average store. There are cases where the multiplier will be lower; for instance, in a store that is in decline, some of the products are out of stock, there is tough competition, or a less attractive niche. On the other hand, in extreme cases, a store may be sold at a higher than average multiplier. Possible reasons include: unique field/product, the growth niche, reports that show a consistent increase in sales and profits, intellectual property, high profitability percentage, future products, correct distribution among the products.

If the brand has external assets outside of Amazon, it can increase its value. For example, suppose it’s active on other platforms like Walmart, Shopify, WordPress, or Etsy. That means other revenue streams also provide security if something happens to the main store on Amazon. So, there are more channels of income related to the store. In addition, any other platform like YouTube, Facebook, Marketplace, Instagram, Tiktok can increase the store’s value, and the multiplier of the store may go up as well.

What is the process for executing a transaction?

After we talk to the seller and agree on the value of the asset for sale, we sign a contract with the Trust The Brokers agency to begin representing the property in the market. In the contract, we sign an agreement of the brokerage fees and exclusivity for a period of up to six months:

Transactions of up to $1 million – the amount of the brokerage fee is about 15%

Transactions of over $1 million – the amount of the brokerage fee is about 10%.

You’re probably reading this and thinking to yourself, huh? Why so much? So first, let us reassure you that this is customary in the field, and if we do not sell you the property, you do not pay anything – no obligation. Many sellers think it is easy to sell a property on their own. We, of course, do not belittle them and wish them all the best. Most of them usually come back to us after failed attempts and once they’ve realized that the process is not that simple, especially for individuals. After signing the agreement with us, we take the reins, and this is where our work begins! We build an investor presentation in Hebrew and English, addressing our pool of potential buyers in Israel and abroad. We then make calls and introduce the business to buyers and investors from all over the world. It is important to note that we also work in partnership with the leading brokers abroad. In addition, Trust The Brokers has unique and exclusive agreements with the top sites in the field, including FLIPPA and EMPIRE FLIPPERS.

Important Tip: We strongly recommend the seller not slowdown in-store activity. Sellers tend to decrease activity as they begin the sales process because they no longer focus on the store’s day-to-day activity. We have seen deals closed at 30% less than their initial value because, during the sale process, the store’s income decreased, and so the transaction of the asset needed to be renegotiated. On the other hand, stores that increase day-to-day revenue during the transaction period may increase the business’s value and, consequently, the transaction value will go up – so it works both ways.

Once a potential buyer is found, he must sign the NDA, and then he will receive all the data about the store. If he needs more details from the seller or wants to meet the seller, we arrange a meeting between the buyer and seller, and if the session ends successfully and the buyer wants to proceed, they sign the sale/purchase agreement. Once it is signed, we move on to the property transfer phase. In the transfer of the property, the buyer becomes the owner of the rights to the property.

Tip: Both parties should bring a lawyer on their behalf who will represent them in a transaction to protect each one’s interests.

After the purchase, when the business is already in the hands of the buyer, an orderly transfer process begins. Some companies require an overlap time of a few weeks, and some require a few months. There are also cases where the buyer employs the seller part-time in the industry or as a consultant. For this to happen, there must be a good connection between the buyer and the seller.

Sometimes people who own an Amazon store come to us and ask us to help them prepare the business for sale in the coming six months or a year. This is the best way to sell a business, first, to improve it and present it as best as possible. Thus, we provide a service to stabilize the business, increase sales, and guide them through necessary actions to make the store attractive to a potential buyer.

Tip: The more profitable, more stable, and more valuable the asset, the more the property will be maximized, and you can demand a higher multiplier.

What is unique in Trust The Brokers Agency?

Some brokerage agencies in the international market choose to focus on high-value Amazon stores solely and won’t deal with smaller transactions.

We at Trust The Brokers aspire to help all e-commerce entrepreneurs, no matter the size of their brand. Smaller stores have also invested countless time, money, and effort into their business and deserve to enjoy the fruits of their labor.

The method in which our agency operates allows us to expand our staff and add more brokers whenever we choose, so we can handle deals that most other agencies could not and do not want to deal with. This also includes stores worth only a few tens of thousands of dollars. These same small shop owners often turn to us again in the future, requesting that we sell bigger stores. In addition, we are big believers in karma and hope everyone has an equal chance to sell their store no matter what the size.

Fill out your details here, and we will contact you.

What about investing in Amazon Stores

Another area developing at the agency is silent investing in Amazon FBA stores. If you are looking for a passive and profitable investment deal with relatively low risk, contact us to enter the investor waiting list.

Occasionally we get asked to help improve an Amazon property when the property owner wants to stay and manage the store but is looking for a financial investment to develop and promote it. Here we enter the picture and locate a silent partner that wants to receive a percentage of the store. Then, we run the store together with the store owner, helping to prepare it for a potential sale at the end of a year of improvement. Due to this, a high percentage of profit and return on the investment are very likely.

Tip: Every time we raise money for a store that we believe has great improvement potential, we first turn to our list of investors, and they get priority before we advertise the investment on our other channels. Make sure to get on the waiting list for silent investors.

Trust The Brokers Amazon Department – we are here for you

Our agency has extensive experience working with Amazon. We’ll share our knowledge of what to look for in an Amazon store and guide you in the steps to execute the transaction. Feel free to leave your details so we can reach out and start the process! Omer Sidi runs the agency’s Amazon department. He has primarily focused on Amazon for the past six years, owns several stores, and is an external consultant to private sellers and companies. In the past, Omer studied law and has the bonus of speaking English as a mother tongue. As a result, he has the professional and legal knowledge to help our clients and accompany them in making successful deals. This conversation with Omer took place after a very successful Amazon deal and money transfer.