It appeared like 2020 was fierce and could not be surpassed. Even so, just three months into 2021, and this brand-new year seems to be yelling, “Challenge accepted!”

The world’s actually been on a roller coaster, and it comes as no surprise that so has the world of online markets. We’ve gone into an oddly favorable time, although for a specific trade group of individuals, in spite of the many tight spots this previous year.

Amazon FBA sellers have, unconsciously for the most part, strolled into a market territory inclined in their favor. Singular focus from private equity (PE) surfaced in best-in-class FBA company acquisitions in the last 12 months, and a rise of funds behind them is sponsoring an acquisition splurge.

The transaction structures, demand, and timeframes to protect these acquisitions differ from anything we’ve ever seen. Throughout a disorderly year, we went into a brand-new period for online acquisitions at an excessive pace.

It’s time for everybody, particularly sellers, to keep track of what is taking place in the market. The increase of new funds and purchaser needs is having a domino effect throughout our market.

It’s the perfect condition for sellers. You’re either taking advantage of it or losing out.

Why purchaser needs and multiples are increasing

Amazon is not a billion-dollar playing field exclusively for Jeff Bezos anymore.

Brands of institutional financiers are rousing to the unbelievable ROI and fast development offered for them with Amazon FBA because of a lot of fearless FBA procurers who set an example. With the ideal FBA accessions and functional performance carried out, FBA properties have actually shown to be scalable and exceptionally rewarding. Hence, an FBA gold rush emerged.

What was simply a couple of institutional financiers purchasing from our market a number of years back has actually progressed into many portfolio purchasers with funds behind them.

PE crowds have actually entered into aggressive raising of funds. There’s been $1.5 billion gained from 10 to 15 groups for Amazon FBA acquisitions, as reported by Forbes. Furthermore, our market itself has more than $1 billion in confirmed funds, just a part of the fund readily accessible in the purchaser’s total assets to release.

Despite the fact that funds for acquisitions surpassed the billion-dollar point, we’re acutely conscious there’s more funds rising into the digital procurement area. We are only able to divulge the capital that was tracked. At this point, that’s most likely just a portion of capital that’s really accessible.

It may safely be said that there’s significant cash to be invested in FBA companies. This now implies sellers of big FBA organizations remain in the best place for action. Thanks to purchaser needs and increased accomplishments of FBA companies, FBA sale multiples have actually seen a substantial increase.

An increasing tide raises all boats. The worth of online services across the board has actually grown now that FBA is requiring premium multiples. Practically all sellers are taking pleasure in a high season.

Just how much are multiples increasing? A 1 year picture

To put the “high season” into viewpoint, here’s what our information has actually exposed on market boosts:

In 2020, we offered 298 services worth an overall of $81,636,851.73. That’s a 10% boost from the previous year in regards to companies offered and a 66% boost in total sales volume. To break this down even more, in Q4 of 2019 we offered 58 listings while Q4 of 2020 82 listings– a 41% boost.

The typical sale price of a service on our market ($ 284,838.04) was up 58% compared to 2019, while the typical price increased 73% to $269,200.81.

To comprehend how multiples have actually increased, we initially need to discuss TTM (Trailing Twelve Months) sales.

TTM is basically a typical based upon the routing twelve month efficiency. Many companies on our market utilize a 12 month prices window, nevertheless, some organizations utilize a much shorter prices window (six-months or three-months, for instance) as its finest represents the existing truth of an offered company.

For ease of comparing our assessments to other brokers throughout the market, we are moving towards more basic use of TTM multiples and it will likely end up being more common on our market over the coming months and years.

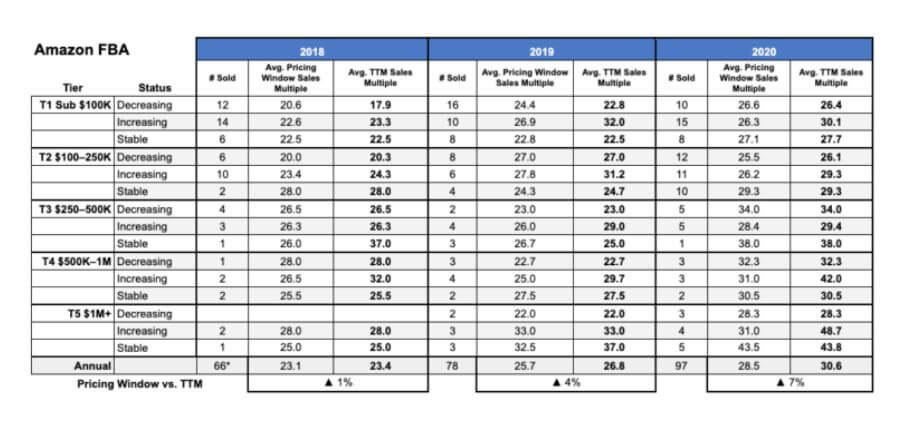

We break down TTM multiples in 2019 vs. 2020 in the chart listed below. While the information reveals an intriguing shift in general, what feels most amazing is a YoY (year over year) contrast of the information. Comparing YoY reveals a typical 31.5 x to a 40.9 x TTM sales number, which is a 9.4 x distinction from Q4 2019 to Q4 2020

.

It’s amazing to see 2020 have a favorable effect someplace on the planet, though it was FBA in particular that experienced an outstanding year. The information of organizations on our market with Amazon FBA generated most of revenue and soared from the 2019 information:

- Sticker price increased 55%.

- List price increased 80%.

- The typical sale number (TTM) increased 14%.

- Overall sales increased 98%.

- The Season of the Seller

What makes this information much more fantastic is that these are services that had actually gone from being essentially disabled for months at the start of the pandemic to hardly able to keep stock on hand. Whatever appeared stacked versus FBA midway through 2020, and FBA services managed to end up the year with transformational profits and need.

The final moments of 2021 genuinely were transformative for FBA. By Q4, we saw information that would’ve been indistinguishable the past year:

- Typical prices of FBA — Q4 2019: $448,940.59 vs. Q4 2020: $1,561,931.24

- The biggest FBA service offered– Q4 2019: $2,124,893.00 vs. Q4 2020: $11,800,000.00

- Overall FBA deals — Q4 2019: $10,848,929.57 vs. Q4 2020: $38,794,388.91

It does not take a mathematics genius to recognize that going from $10,846,929.57 to $38,794,388.91 of overall FBA sales is a radical change. For closer examination, and one that determines the development we mention the majority of in this short article, it’s crucial to keep in mind the several leaps in solid FBA possessions. Comparing 2019 to 2020 FBA TTM multiples in expanding FBA companies over the $1M variety reveals an engaging boost:

- Typical TTM multiple increasing + $ 1M FBA organizations in 2019 vs. 2020 — 2019: 33x vs. 2020: 48.7 x (15.7 x distinction)

- Overall Number of traded of growing + $ 1M FBA organizations in 2019 vs. 2020 — 2019: 3 vs. 2020: 4 (33.3% boost)

The pace in which the FBA market has actually altered in 12 months reveals to us that assumptions surrounding FBA offers are dynamic.

Even though we’d never recommend timing the marketplace, if you’re set to offer, you’re going to discover that you’re in the very best time we’ve ever perceived to put an FBA organization on the market.

What big purchasers are looking for.

While investor needs and multiples are, in fact, increasing, the extremely high need belongs mainly to the upper tier of FBA organizations.

The purchasing pattern appears primarily clear cut; PE purchasers are typically searching for less than 30 SKUs, the primary SKUS having 4.7+ star evaluations with 1,000 plus evaluations on listings, and terrific branding to sustain the brand name’s development.

They primarily appear to be purchasing in the $500,000 to $15 million-plus scale, as these companies can be obtained and enhanced to get the returns financiers desire. The purpose of us pointing this out is we wish to make it clear who’s getting 50x, even more, multiples. These organizations can require these multiples based upon their quality, charge point, and purchaser’s eagerness.

While all sellers can see an advantage to greater multiples across the board, the strength of big purchaser needs stays with multi-million-dollar FBA services.

Sellers are careful, how sellers require to be cautious in the fad.

The sellers who have actually established such strong FBA companies are plainly proficient at what they do. They were able to reach a limit of success millions can just imagine.

They are masters of selling items on Amazon, it does not relate to being able to offer multi-million-dollar organizations with nuanced intricacies. And this is where sellers can lose on their effort.

While it’s appealing to do all of it alone and install your own “for sale by owner” indication to make the most cash possible in an exit, doing so suggests you’re losing out.

Great deals of sellers are leaving money on the table selling by themselves. Since they merely do not understand how to price themselves properly in a hot market, they’re getting undersold.

They do not understand what they do not understand, and the ones benefiting are skilled purchasers whose success depends on getting the very best offer possible on their own and their financiers.

Circumstantially, these upper-echelon sellers are verifying this. Almost all of them are getting approached by purchasers to offer to them straight, and all of them are getting pitched at prices less than what they’d manage selling on our market.

That’s why there never has actually been a much better moment to utilize a broker.

Purchasers aren’t willing to pay more than they need to only UNTIL they need to. And they will be obligated to do so when you sell with a broker.

A number of these groups similar to PE are awesome FBA operators and aggregators. The ones who guarantee to run your organization well and let you take part in their accomplishment with an achievement earnout are expected to do their best to achieve it. A year earlier, the companies who might follow through on what they guaranteed were few but they are growing more every day.

It’s a restricting belief to believe that there’s only a single company who would seriously ponder on purchasing your business. You are worthy of a deal from every possible purchaser contending for FBA assets. The only method to acquire all those purchasers in the space to offer competitive deals for your service is to employ a broker.

You might offer your FBA service to these institutional purchasers, and your company might continue to sustain among these big groups’ specialties.

At least acquire what your company is worth, if you’re going to build someone else’s legacy.

Pro-seller offer structure patterns.

The offer structures emerging from strong competitors have unequaled advantages for sellers. Never has a seller left with more money in advance with a lot more promise to make money from the business after it’s sold.

What various types of levers can purchasers pull?

Considering that purchasers are concentrated on surpassing other purchasers to win the very best FBA organizations in the market, the ball is quite in the seller’s court. Here steady levers we see purchasers pull to get ahead of the pack:

Up-front payment quantity: Winning bids for bigger, 7-figure FBA organizations generally consist of the most amount of money paid in advance. In 2020, eleven of the twelve $1M+ organizations offered were earnouts where a typical 65.88% was paid in advance. As rivalry soar, the portion paid in advance will continue to increase.

Earnout payment timeline and terms: If an earnout is incorporated in these offers, they typically focus on future efficiency of business and are paid on an annual basis. For big performance-based earnouts, the seller is required to rely on the purchaser’s capability to run an Amazon organization that strikes these productivity metrics for the payment to be launched.

Listing payment and timetable to pay: All stock is typically compensated at the close of the offer or no more than 3 months after close.

Unique due diligence timetable: Most or all deals for bigger companies on our market will consist of a time of unique due diligence. The purchaser will wish to validate more the monetary, banking, and stock details prior to dedicating to the sale. The basic timeline is 30 days, however the quickest timeline is chosen.

Seller backing timeline and required work: Sellers want to provide as little help as possible (they mostly want to close the deal and enjoy the rewards of selling), and skilled portfolio purchases can progress without much help from the seller. This differs from offer to offer depending on the experience of the competence of the purchaser or complexity of the company.

Usually, out-of-the-box offers originate from less recognized competitors in the market. More recent brand names are making assertive deals since they need to get ahead with these companies, so they are offering creative or very high deals to attempt to beat more popular competitors.

What does this mean for purchasers?

If they had been out of the market for some time, buyers may have noticed the rise in multiples and been a bit perplexed. Those who have actually been active in bidding on big FBA companies can validate directly how intense the competitors are and comprehend why multiples have actually climbed up the method they have.

This ought to not trigger any lost hope; consider this friendly expectation setting. We wish to see purchasers get the business and win right for them.

The following is our finest guidance to win in the present market environment:

Purchasers of FBA services from $500,000 to $15 million.

You must be prepared to meet the multiple if you are a purchaser resolute on acquiring FBA companies in the upper six-figure and multi-million-dollar price range. You’ll probably require all money in advance to fulfill the listing rate. You might even be required to produce additional rewards on the top to get ahead of other purchasers. You’ll also have to be quick

Whereas offering a deal five days after a business was listed on the market could have gotten you the deal a couple of years ago, that isn’t going to work anymore. Your alarm has to be set for 10 AM Eastern Standard Time, Mondays, when deals go live.

Purchasers of smaller sized FBA services and other money makings.

That’s okay if you think these calculated moves seem impossible to obtain. You do not get into the aggressive rivalry to get an awesome company. You may just need to pivot, if you had great expectations for an FBA company in the price range discussed above.

Think about services that’ve been on the market longer to prevent fast-moving competitors. You can also take chances in the smaller rate businesses, or obtain distressed properties and pursue to enhance them.

Organizations beyond the leading purchaser’s requirements have an excellent level of chance for innovative offer structures. There’s no reason you can’t win against the competition if you are able to come up with well-founded, unconventional transaction structures and situate the essential resources.

How can sellers profit now?

This is an awesome time to put your business in the market. We’re seeing sellers able to select in between a lot of purchasers on multi-million-dollar services using extra incentives and strong deals to surpass the competitors.

Sellers, likewise, can benefit from the most affordable commission we’ll ever use on 7- and 8-figure companies. As we offer more 7-figure and 8-figure transactions routinely, our rates will escalate. This really is the season of the seller.

Keep in mind, you wish for all prospective purchasers in the very same space taking a look at your company at the same time. It develops a healthy shortage and makes every group work more to produce engaging deals.

If you offer independently, you do not understand the opposite of what you might make with a brokerage, even after the commission. You miss out on the opportunity to understand for sure if somebody else would have paid more for what you’ve established, provided you much better terms, and made the offer procedure far simpler for you. Nobody ought to need to ask “what if” when there are countless dollars on the line.

What the future holds.

The year 2020 was turbulent, and if we pick up any lessons from that, it’s that nobody can properly forecast what will take place. Evaluating by how 2021 has actually begun, it appears like predictability is still off the table in the meantime. We can just hedge bets and do the very best we can with what we understand.

We understand the pandemic sustained unrivaled development in ecommerce, and Amazon FBA companies saw profits they only believed possible in their imagination. The rise of online purchases on Amazon made numerous FBA companies far more important.

We likewise understand that purchaser needs have actually increased. What was simply a handful of institutional purchasers 2 years earlier is now a growing number of purchasers going into the niche each day. There is no cause to think this pattern will stop anytime quickly.

Needs and multiples will probably continue to rise to unmatched levels, though nobody can state the length of time this will last. Offering while purchaser need is strong and the population depends on the web for their purchases will likely cause a winning circumstance for sellers.

Sellers — this is your time. Unlike ever before, the market is yours.

All Article based on Data from Empire Flippers Website!